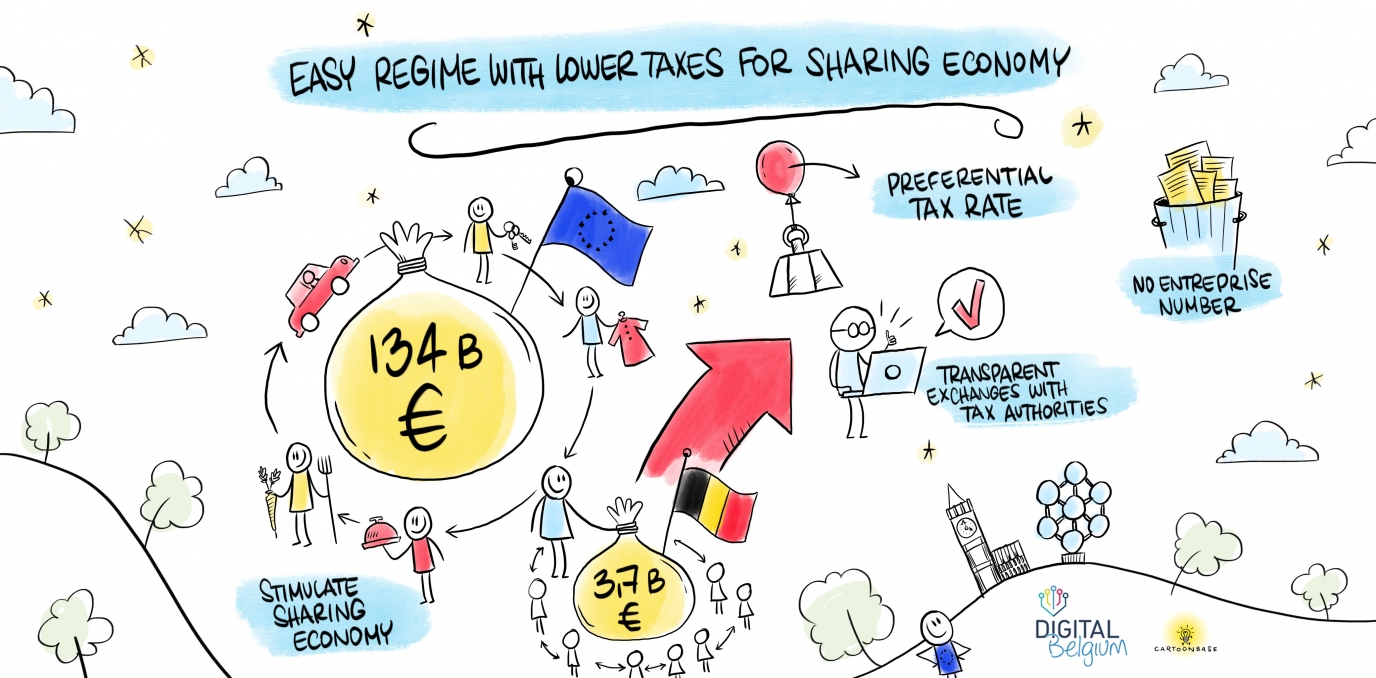

Lower taxes and easy tax regime for sharing economy

Alexander De Croo: “The sharing economy, or peer-to-peer economy, is developing rapidly. Through apps and digital platforms, private individuals provide an increasing number of services for their peers, from car sharing to meal delivery and babysitting. Our current fiscal model has not adjusted to the reality of this new economy. A loud demand for clear and transparent regulation was heard. It is in place now. This is important because it is a way for many people to earn a little extra on the side, or to get a sense of entrepreneurship on a small scale.”

Simple and Transparent

As the Minister of Digital Agenda, Alexander De Croo wants to provide additional support for this group of mini-entrepreneurs, as well as give them greater latitude. In the period leading up to the Budgetary Control, he introduced simple and transparent regulations which result in lower tax rates, and more simplicity and transparency. Most activities in the sharing economy are currently taxed at 33 percent. The number is far too high for services provided in the sharing economy. The exact income threshold to which lower tax rates will apply, will be determined within the next few weeks. Any impact on financing of the social security system must also be examined.

In addition, the fiscal information stream will be reversed. Specifically, deduction occurs at the source, and digital platforms send the necessary information to tax authorities in the same way employers currently do for their employees. For those who plan to work a second job in the sharing economy, the administrative charge will be minimal. They will not be mandated to register with the KBO (Belgian Enterprises Register) or apply for a VAT number.

At the Forefront in Europe

With this decision, Belgium moves to the forefront of the peer-to-peer economy in Europe. Up to now, the United Kingdom has been the leader in stimulating the sharing economy. Last month, the British Chancellor of the Exchequer announced a tax exemption of up to 2500 euro for incomes earned in the sharing economy. The government of France recently rejected a proposal for advantageous treatment of such income up to 5000 euro.

Those who want to turn a second job in the sharing economy into a profession, must switch to self-employed status as primary or secondary profession. New regulations will also guard against unfair competition with professionals.